The basics

A

normal distribution has two parameters, the mean

![]() which indicates where the bell curve is

centered and

the standard deviation

which indicates where the bell curve is

centered and

the standard deviation ![]() which indicates the shape of the bell curve. From a frequentist point of view,

which indicates the shape of the bell curve. From a frequentist point of view, ![]() and

and ![]() are fixed quantities. From a Bayesian point of

view, they are random variables each with their own distribution, mean and

standard deviation.

are fixed quantities. From a Bayesian point of

view, they are random variables each with their own distribution, mean and

standard deviation.

If

a researcher has a set of data that appears to follow a normal distribution, we

would like to find the distributions of ![]() and

and ![]() .

.

If

the researcher does not have a clear idea as to what distribution ![]() and

and ![]() jointly follow, Jeffreys

suggested a diffuse prior distribution to indicate this lack of knowledge. When

this prior distribution is combined with the data (known as the likelihood),

the joint posterior distribution of

jointly follow, Jeffreys

suggested a diffuse prior distribution to indicate this lack of knowledge. When

this prior distribution is combined with the data (known as the likelihood),

the joint posterior distribution of ![]() and

and ![]() does not follow any readily identifiable

distribution.

does not follow any readily identifiable

distribution.

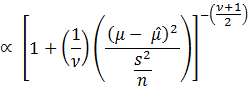

However,

once we solve for just ![]() from the joint posterior distribution, we find

that it follows a t distribution with the mean equal to

from the joint posterior distribution, we find

that it follows a t distribution with the mean equal to ![]() which represents the sample mean of the data

and the variance equal to

which represents the sample mean of the data

and the variance equal to

![]()

in which ![]() represents the sample standard deviation of

the data. Note that the sample size needs to be more than 3 in order to have a

standard deviation. The other thing to note is that as the sample size

increases, the standard deviation of

represents the sample standard deviation of

the data. Note that the sample size needs to be more than 3 in order to have a

standard deviation. The other thing to note is that as the sample size

increases, the standard deviation of ![]() gets closer to zero.

gets closer to zero.

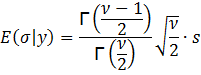

Similarly,

once we solve for just ![]() from the joint posterior distribution, we find

that it follows an inverse gamma distribution with the mean equal to

from the joint posterior distribution, we find

that it follows an inverse gamma distribution with the mean equal to

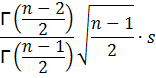

where ![]() is the gamma function of x. To have a mean,

the sample size needs to be more than 1. The variance is

is the gamma function of x. To have a mean,

the sample size needs to be more than 1. The variance is

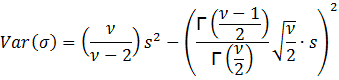

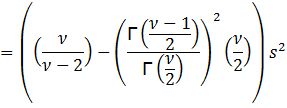

![]()

To

derive the standard deviation, we take the square root of the above quantity.

To have a standard deviation, the sample size needs to be more than 3.

Example

Suppose

a researcher takes a sample of 10 observations of people buying gas at a

service station:

|

39.62 |

48.21 |

52.48 |

57.06 |

57.24 |

|

60.04 |

63.64 |

68.05 |

73.98 |

81.24 |

Analysis

indicates the data is normally distributed.

We

have ![]() = 60.16,

= 60.16, ![]() = 12.2545,

= 12.2545, ![]() = 150.17 and

= 150.17 and ![]() = 10.

= 10.

The

posterior distribution of ![]() indicates it follows a t distribution with a

mean of 60.16 and variance of (9/7)(150.17/10) =

19.3078 or a standard deviation of 4.39 with 9 degrees of freedom.

indicates it follows a t distribution with a

mean of 60.16 and variance of (9/7)(150.17/10) =

19.3078 or a standard deviation of 4.39 with 9 degrees of freedom.

Employing

Chebyshev’s theorem, at least 8/9 of the distribution lies between 60.16 –

3(4.39) = 46.99 and 60.16 + 3(4.39) = 73.33.

The

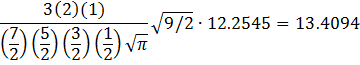

posterior distribution of ![]() follows an inverse gamma distribution with a

mean of

follows an inverse gamma distribution with a

mean of

The

variance is

![]()

The

standard deviation is then the square root of 13.2663 which is 3.64.

Employing

Chebyshev’s theorem, at least 8/9 of the distribution lies between 13.41 – 3(3.64)

= 2.49 and 13.41 + 3(3.64) = 24.33.

Then,

returning to the distribution of X, we can construct a table indicating the

range of ![]() depending on their values:

depending on their values:

|

μ |

σ |

2.49 |

13.41 |

24.33 |

|

46.99 |

(39.52,

54.46) |

(6.76,87.22) |

(0,

119.98) |

|

60.16 |

(52.69,

67.63) |

(19.93,

100.39) |

(0,

133.15) |

|

73.33 |

(65.86,

80.80) |

(33.10,

113.56) |

(0.34,

146.32) |

Of

these ranges, the one with μ = 60.16 and σ = 13.41 seems the most

plausible. As more data is added, the range of μ and σ will tighten up.

For example, I generated 1000 normal random numbers with a mean of 60.16 and

standard deviation of 13.41. The mean of the data is 60.21 and the sample

variance is 182.0687. Based on this data, μ follows a t distribution with

a mean of 60.21 and standard deviation of 0.43 and σ follows an inverse

gamma distribution with a mean of 13.50 and standard deviation of 0.30.

Technical details

If

the researcher is starting from scratch, the joint prior distribution of ![]() and

and ![]() should convey this. The suggestion made by

Jeffreys is to have

should convey this. The suggestion made by

Jeffreys is to have

![]() .

.

Since

our data appears to follow a normal distribution, each value y follows this distribution:

![]()

Given

the random sample ![]() , the likelihood

function is:

, the likelihood

function is:

![]()

![]()

where ![]() represents the sample mean of the data.

represents the sample mean of the data.

The

expression ![]() is derived as follows:

is derived as follows:

![]()

![]()

![]()

![]()

The

first term is derived from the fact that ![]() .

.

There

is no middle term from FOIL since ![]() .

.

Then

![]()

![]()

Posterior Distribution of μ

To

derive the posterior distribution of ![]() , we integrate

, we integrate ![]() with respect to

with respect to ![]() .

.

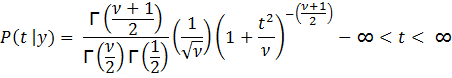

We

use the substitution ![]() in which

in which ![]() represents the degrees of freedom. The result

is:

represents the degrees of freedom. The result

is:

![]()

Thus,

![]() follows a t distribution.

follows a t distribution.

If

we let

then

where ![]() is the gamma function

of x.

is the gamma function

of x.

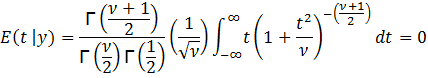

To

find the mean of t, E(t | y), we have:

This

follows since ![]() is an odd function of t. From that we derive

is an odd function of t. From that we derive ![]() and consequently

and consequently ![]() provided

provided ![]() > 1. Note that if

> 1. Note that if ![]() = 1, the integral does not provide a finite

solution. (In fact, t would follow a Cauchy distribution.)

= 1, the integral does not provide a finite

solution. (In fact, t would follow a Cauchy distribution.)

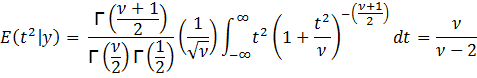

Since

E(t) = 0, the variance of t, Var(t)

= E(t2)

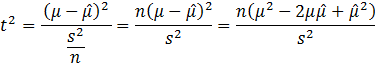

Since

then

![]()

![]()

![]()

This

follow from the previous derivation of ![]() .

.

Then,

![]()

This

indicates that as the sample size increases, the variance of ![]() decreases.

decreases.

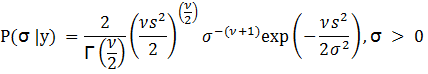

Posterior Distribution of σ

To

derive the posterior distribution of ![]() , we integrate

, we integrate ![]() with respect to

with respect to ![]() .

.

We

use the substitution ![]() . The result is:

. The result is:

![]()

This

is in the form of an inverse Gamma distribution. Thus,

In

this case, ![]() and

and ![]() .

.

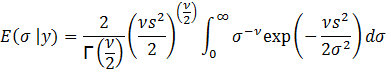

To

find the mean of σ, E(σ | y), we have:

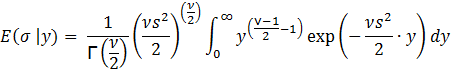

Let

y = 1/σ2. Then σ2 = y-1 leading to

σ = y-0.5 and dσ = -0.5y-1.5

dy. Substituting, we get:

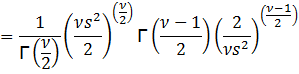

The

last line follows from the equation for the gamma function:

![]()

Then,

To

find the variance of σ, we need E(σ2

| y):

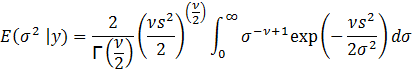

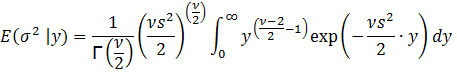

Again,

let y = 1/σ2. Then σ = y-0.5 and dσ = -0.5y-1.5 dy. Substituting, we get:

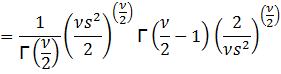

![]()

Then

Thus,

we need ![]() > 2 in order to have a variance and

subsequently a standard deviation.

> 2 in order to have a variance and

subsequently a standard deviation.

Reference:

Zellner, Arnold. An Introduction to Bayesian

Inference in Econometrics. New York: John Wiley & Sons, 1970.