![]()

Seemingly Unrelated Regression

Model using Gibbs Sampler

Home | Academic Articles

Purpose

The purpose of the seemingly

unrelated regression (SUR) model using Gibbs sampler is to create a model that

has a better fit than the corresponding model under the Frequentist school.

Example

Let’s suppose we

have 3 sets of data to create 3 models.

Here is the first

data set:

|

y |

2.1 |

4.5 |

6.8 |

9.4 |

10.8 |

|

X1 |

1 |

2 |

3 |

4 |

5 |

And the second:

|

y |

4.8 |

9.6 |

13.7 |

19.6 |

21.4 |

|

X2 |

1 |

2 |

3 |

4 |

5 |

|

X3 |

0.25 |

0.42 |

0.84 |

1.32 |

1.64 |

And the third:

|

y |

0.5 |

1.1 |

1.4 |

2.3 |

3.4 |

|

X4 |

10.2 |

20.5 |

30.4 |

41.6 |

50.2 |

Using least squares, the summary statistics

for each of the coefficients are:

Model #1

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

Lower 95% |

Upper 95% |

|

Intercept |

0.03 |

0.3728 |

0.0805 |

0.9409 |

-1.1564 |

1.2164 |

|

X1 |

2.23 |

0.1124 |

19.8402 |

0.0003 |

1.8723 |

2.5877 |

Model #2

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

Lower 95% |

Upper 95% |

|

Intercept |

1.1418 |

2.1708 |

0.5260 |

0.6514 |

-8.1986 |

10.4822 |

|

X2 |

3.8261 |

2.9894 |

1.2799 |

0.3290 |

-9.0363 |

16.6886 |

|

X3 |

1.3420 |

8.0463 |

0.1668 |

0.8829 |

-33.2786 |

35.9626 |

Model #3

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

Lower 95% |

Upper 95% |

|

Intercept |

-0.3674 |

0.3177 |

-1.1562 |

0.3313 |

-1.3786 |

0.6438 |

|

X4 |

0.0689 |

0.0094 |

7.3223 |

0.0053 |

0.0390 |

0.0989 |

If all the variables are combined into one

model, this is the result:

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

Lower 95% |

Upper 95% |

|

Intercept |

0.0492 |

0.4615 |

0.1066 |

0.9172 |

-0.9791 |

1.0775 |

|

x1 |

2.2248 |

0.1557 |

14.2931 |

0.0000 |

1.8779 |

2.5716 |

|

x2 |

5.1036 |

0.9861 |

5.1753 |

0.0004 |

2.9064 |

7.3009 |

|

x3 |

-1.8103 |

2.9568 |

-0.6122 |

0.5540 |

-8.3984 |

4.7778 |

|

x4 |

0.0577 |

0.0153 |

3.7725 |

0.0036 |

0.0236 |

0.0918 |

The goal is to create models that solve for the

coefficients simultaneously. Arnold Zellner introduced a concept called the

seemingly unrelated regression (SUR) model.

As explained in the technical details, the

Gibbs sampler was run for 50,000 iterations.

If one has two models, the one that has the

lower sum of squared errors is the model with the better fit.

In regard to the sum of the squared errors, these are the results:

|

SUR |

Model

#1 |

Model

#2 |

Model

#3 |

Frequentist |

|

4.0339 |

0.379 |

3.3770 |

0.2719 |

4.6119 |

The sum of squared errors

is less for each of the individual models than for the SUR model which, in

turn, is less than that of the Frequentist model. It should be noted that when

the Gibbs sampler is run for 100,000 iterations, the sum of squared errors goes

down to 4.0331 which would seem to suggest that running the extra 50,000

iterations is not worth the while.

Technical details

In the SUR model, this is how the data would

be set up:

|

y1 |

x1 |

x2 |

x3 |

x4 |

|

2.1 |

1 |

0 |

0 |

0 |

|

4.5 |

2 |

0 |

0 |

0 |

|

6.8 |

3 |

0 |

0 |

0 |

|

9.4 |

4 |

0 |

0 |

0 |

|

10.8 |

5 |

0 |

0 |

0 |

|

4.8 |

0 |

1 |

0.25 |

0 |

|

9.6 |

0 |

2 |

0.42 |

0 |

|

13.7 |

0 |

3 |

0.84 |

0 |

|

19.6 |

0 |

4 |

1.32 |

0 |

|

21.4 |

0 |

5 |

1.64 |

0 |

|

0.5 |

0 |

0 |

0 |

10.2 |

|

1.1 |

0 |

0 |

0 |

20.5 |

|

1.4 |

0 |

0 |

0 |

30.4 |

|

2.3 |

0 |

0 |

0 |

41.6 |

|

3.4 |

0 |

0 |

0 |

50.2 |

Of course, for each

model, you would still need a vector of 1s for the intercept, which leads to

this matrix which I call the X new matrix:

|

y1 |

x10 |

x11 |

x20 |

x21 |

x22 |

x30 |

x31 |

|

2.1 |

1 |

1 |

0 |

0 |

0 |

0 |

0 |

|

4.5 |

1 |

2 |

0 |

0 |

0 |

0 |

0 |

|

6.8 |

1 |

3 |

0 |

0 |

0 |

0 |

0 |

|

9.4 |

1 |

4 |

0 |

0 |

0 |

0 |

0 |

|

10.8 |

1 |

5 |

0 |

0 |

0 |

0 |

0 |

|

4.8 |

0 |

0 |

1 |

1 |

0.25 |

0 |

0 |

|

9.6 |

0 |

0 |

1 |

2 |

0.42 |

0 |

0 |

|

13.7 |

0 |

0 |

1 |

3 |

0.84 |

0 |

0 |

|

19.6 |

0 |

0 |

1 |

4 |

1.32 |

0 |

0 |

|

21.4 |

0 |

0 |

1 |

5 |

1.64 |

0 |

0 |

|

0.5 |

0 |

0 |

0 |

0 |

0 |

1 |

10.2 |

|

1.1 |

0 |

0 |

0 |

0 |

0 |

1 |

20.5 |

|

1.4 |

0 |

0 |

0 |

0 |

0 |

1 |

30.4 |

|

2.3 |

0 |

0 |

0 |

0 |

0 |

1 |

41.6 |

|

3.4 |

0 |

0 |

0 |

0 |

0 |

1 |

50.2 |

In the frequentist school, the beta vector

β and the covariance matrix of the error terms ∑ are fixed

quantities. However, in the Bayesian school, β follows a normal

distribution and ∑ follows an inverse Wishart distribution.

This is the basic

way the Gibbs sampler works for the SUR model: Start off with least squares as

in the frequentist school. From that, you create the E matrix of the error

terms. Since there are 3 models and each model has 5 rows, the E matrix is a

5x3 matrix. For the above models, this would be the E matrix:

|

-0.16 |

-0.5040 |

0.1645 |

|

0.01 |

0.2414 |

0.0546 |

|

0.08 |

-0.0492 |

-0.3276 |

|

0.45 |

1.3795 |

-0.1994 |

|

-0.38 |

-1.0767 |

0.3079 |

From that, you create

the S matrix which is E’E. For the above models, this would be the S matrix:

|

0.3790 |

1.1090 |

-0.2587 |

|

1.1090 |

3.3771 |

-0.6602 |

|

-0.2587 |

-0.6602 |

0.2719 |

It should be noted

that the diagonal elements are equivalent to the sum of squared errors

(residuals) from the regression ANOVA table for each model.

To get the sigma

matrix, we divide the elements by the number of rows in each model. Since there

are 5 rows, this is the sigma matrix for the above data:

|

0.0758 |

0.2218 |

-0.0517 |

|

0.2218 |

0.6754 |

-0.1320 |

|

-0.0517 |

-0.1320 |

0.0544 |

As you notice from the above matrix, the error

terms are correlated. However, we

would like uncorrelated errors. The way we do

that is by first computing the lower Cholesky root of the sigma matrix which we

call the L matrix. This would be the result:

|

0.275318 |

0 |

0 |

|

0.805645 |

0.162314 |

0 |

|

-0.18795 |

0.119367 |

0.069388 |

We then take the

inverse of the L matrix:

|

3.6322 |

0.0000 |

0.0000 |

|

-18.0282 |

6.1609 |

0.0000 |

|

40.8517 |

-10.5985 |

14.4117 |

The dimensions of

the X new matrix are 15x7. However, the dimensions of L inverse matrix

are 3x3. To create a 15x15 matrix, we compute the Kronecker product of the L

inverse matrix and the identity matrix of dimensions 5x5, since each model has

5 rows. This is what the result looks like for the first 5 rows and columns:

|

3.6322 |

0 |

0 |

0 |

0 |

|

0 |

3.6322 |

0 |

0 |

0 |

|

0 |

0 |

3.6322 |

0 |

0 |

|

0 |

0 |

0 |

3.6322 |

0 |

|

0 |

0 |

0 |

0 |

3.6322 |

We then create the ![]() matrix

which is the product of the above Kronecker

matrix

which is the product of the above Kronecker

product and the X new matrix.

|

14.4117 |

14.4117 |

0 |

0 |

0 |

0 |

0 |

|

3.6322 |

7.2644 |

0 |

0 |

0 |

0 |

0 |

|

3.6322 |

10.8966 |

0 |

0 |

0 |

0 |

0 |

|

3.6322 |

14.5288 |

0 |

0 |

0 |

0 |

0 |

|

3.6322 |

18.161 |

0 |

0 |

0 |

0 |

0 |

|

-18.0282 |

-18.0282 |

6.1609 |

6.1609 |

1.540225 |

0 |

0 |

|

-18.0282 |

-36.0564 |

6.1609 |

12.3218 |

2.587578 |

0 |

0 |

|

-18.0282 |

-54.0846 |

6.1609 |

18.4827 |

5.175156 |

0 |

0 |

|

-18.0282 |

-72.1128 |

6.1609 |

24.6436 |

8.132388 |

0 |

0 |

|

-18.0282 |

-90.141 |

6.1609 |

30.8045 |

10.10388 |

0 |

0 |

|

40.8517 |

40.8517 |

-10.5985 |

-10.5985 |

-2.64963 |

14.4117 |

146.9993 |

|

40.8517 |

81.7034 |

-10.5985 |

-21.197 |

-4.45137 |

14.4117 |

295.4399 |

|

40.8517 |

122.5551 |

-10.5985 |

-31.7955 |

-8.90274 |

14.4117 |

438.1157 |

|

40.8517 |

163.4068 |

-10.5985 |

-42.394 |

-13.99 |

14.4117 |

599.5267 |

|

40.8517 |

204.2585 |

-10.5985 |

-52.9925 |

-17.3815 |

14.4117 |

723.4673 |

We can also create the ![]() vector which

is the product of the Kronecker product and the y vector. This is what it looks

like for this data:

vector which

is the product of the Kronecker product and the y vector. This is what it looks

like for this data:

|

30.26457 |

|

16.3449 |

|

24.69896 |

|

34.14268 |

|

39.22776 |

|

-8.2869 |

|

-21.9823 |

|

-38.1874 |

|

-48.7114 |

|

-62.8613 |

|

42.12162 |

|

97.93992 |

|

152.7685 |

|

209.4223 |

|

263.3902 |

This is the point

at which the Bayesian approach departs from that of the frequentist school.

We start with the

prior distributions of β and ∑. To do that, we introduce some new

terms.

The ![]() vector is

the average of previous beta vectors. If there are no previous beta vectors, it

is a vector of 0s.

vector is

the average of previous beta vectors. If there are no previous beta vectors, it

is a vector of 0s.

The A matrix is

known as the precision matrix. To say there is a bit of literature on this

matrix is a tad of an understatement. However, in a PDF file put together by

Peter E. Rossi (one of the authors of Bayesian Statistics and Marketing), I

found a formulation of it by multiplying the identity matrix by a scalar of

0.05. As a twist on this, I tried a scalar of the product of the number of

coefficients and 0.01. Since there are 4 X variables and 3 intercepts for a

total of 7 coefficients, the scalar for the A matrix would be 0.07.

The prior

distribution of β follows a normal distribution with the mean equal to ![]() and the

covariance matrix equal to A-1.

and the

covariance matrix equal to A-1.

The V matrix is

constructed by taking the sigma matrix constructed previously and multiplying

it by the degrees of freedom v = n – k in which k represents the number of

coefficients. Since n = 15 and k = 7, we have v = 8 degrees of freedom. For

this data set, this is the V matrix:

|

0.5306 |

1.5526 |

-0.3619 |

|

1.5526 |

4.7278 |

-0.924 |

|

-0.3619 |

-0.924 |

0.3808 |

The prior

distribution of ∑ follows an inverse Wishart distribution with parameters

V and v degrees of freedom.

We now combine the

prior distributions and the data to create the posterior distributions.

In the

frequentist school, B = (X’X)-1(X’Y). However, in the Bayesian

school,

![]() = (X’X

+ A)-1(X’Y + A

= (X’X

+ A)-1(X’Y + A![]() ).

).

Once ![]() is

constructed, the posterior distribution of β follows a normal distribution

with the mean of

is

constructed, the posterior distribution of β follows a normal distribution

with the mean of ![]() and

covariance matrix of

and

covariance matrix of ![]() .

.

If we assume that

the ![]() vector

is a vector of 0s, then

vector

is a vector of 0s, then ![]() .

.

For this data

set, this is:

|

-0.1569 |

|

2.274553 |

|

0.383083 |

|

4.328316 |

|

0.331196 |

|

-0.24892 |

|

0.066227 |

In order to generate β, we need a vector

of Z values which follows a normal distribution with mean of 0 and standard

deviation of 1. Since there are 7 coefficients, we need a vector of 7 Z values.

Suppose, the computer generates this

vector:

|

0.7839 |

|

2.5079 |

|

1.8482 |

|

-1.2640 |

|

-0.2313 |

|

-0.8057 |

|

0.2340 |

We also need the

lower Cholesky root of ![]() For

this data, the current value of this matrix is:

For

this data, the current value of this matrix is:

|

0.01062 |

-0.00452 |

0.031115 |

-0.01332 |

0.00025 |

-0.00732 |

0.000305 |

|

-0.00452 |

0.003009 |

-0.01327 |

0.008877 |

-0.00019 |

0.003126 |

-0.0002 |

|

0.031115 |

-0.01327 |

0.130568 |

-0.06583 |

0.052223 |

-0.00036 |

0.000331 |

|

-0.01332 |

0.008877 |

-0.06583 |

0.062417 |

-0.09222 |

0.003747 |

-0.00042 |

|

0.00025 |

-0.00019 |

0.052223 |

-0.09222 |

0.249939 |

-0.00112 |

4.36E-05 |

|

-0.00732 |

0.003126 |

-0.00036 |

0.003747 |

-0.00112 |

0.026158 |

-0.00078 |

|

0.000305 |

-0.0002 |

0.000331 |

-0.00042 |

4.36E-05 |

-0.00078 |

3.22E-05 |

The lower root

is:

|

0.103054 |

0 |

0 |

0 |

0 |

0 |

0 |

|

-0.04386 |

0.032934 |

0 |

0 |

0 |

0 |

0 |

|

0.301925 |

-0.00082 |

0.198514 |

0 |

0 |

0 |

0 |

|

-0.12922 |

0.097434 |

-0.13465 |

0.134514 |

0 |

0 |

0 |

|

0.002426 |

-0.00264 |

0.259367 |

-0.42169 |

0.069514 |

0 |

0 |

|

-0.07106 |

0.000278 |

0.10628 |

0.065777 |

-0.01119 |

0.073216 |

0 |

|

0.002959 |

-0.00221 |

-0.00284 |

-0.00151 |

0.00186 |

-0.00196 |

0.000919 |

Since this is a multivariate

normal distribution, we multiply the lower matrix with the Z vector and add ![]() . This is the result:

. This is the result:

|

0.7839 |

|

2.5079 |

|

1.8482 |

|

-1.264 |

|

-0.2313 |

|

-0.8057 |

|

0.234 |

When we multiply

X and β and calculate the error terms, we can create the E matrix:

|

-1.1918 |

4.273625 |

-1.0811 |

|

-1.2997 |

10.37695 |

-2.8913 |

|

-1.5076 |

15.83809 |

-4.9079 |

|

-1.4155 |

23.11312 |

-6.6287 |

|

-2.5234 |

26.25113 |

-7.5411 |

After that, we once again create the S matrix

which is E’E:

|

13.75365 |

-141.416 |

40.85756 |

|

-141.416 |

1600.128 |

-463.527 |

|

40.85756 |

-463.527 |

134.4237 |

The posterior

distribution of ∑ follows an inverse Wishart distribution with parameters

S + V and degrees of freedom v + n in which n is the number of rows in each

model. For this data set, this is the sum of S and V:

|

14.28425 |

-139.863 |

40.49566 |

|

-139.863 |

1604.856 |

-464.451 |

|

40.49566 |

-464.451 |

134.8045 |

The degrees of

freedom are 8 + 5 = 13.

To generate ∑,

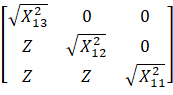

we need the T matrix. Since there are 3 models, the dimensions of the T matrix

are 3 x 3. For this data set, this is the basic setup of the T matrix:

For example, ![]() is a

chi-square variable with 13 degrees of freedom.

is a

chi-square variable with 13 degrees of freedom.

Suppose, the

following T matrix is generated:

|

7.201962 |

0 |

0 |

|

-0.1135 |

15.26426 |

0 |

|

0.567206 |

0.759346 |

8.226725 |

We also need U which is the upper Cholesky

root of the S + V matrix:

|

3.779451 |

-37.0062 |

10.71469 |

|

0 |

15.34273 |

-4.42824 |

|

0 |

0 |

0.624956 |

We then generate

C = T’U:

|

51.86826 |

-2.54992 |

8.665058 |

|

0 |

232.9976 |

17.83779 |

|

0 |

0 |

67.679 |

Finally, ∑

= (C-1)(C-1)’ :

|

0.000378119 |

3.76071E-06 |

-3.72939E-05 |

|

3.76071E-06 |

1.96999E-05 |

-1.6714E-05 |

|

-3.72939E-05 |

-1.6714E-05 |

0.000218319 |

We then use this ∑ to generate

the next β and so on. After running 50,000 iterations of the Gibbs

sampler, the averages of the generated β and ∑ are calculated. This is due to the random Z and ![]() values that are generated in each

iteration. This is a result

for β:

values that are generated in each

iteration. This is a result

for β:

|

Coefficient |

Beta

(Gibbs) |

SE

(Gibbs) |

Beta

(LS) |

SE

(LS) |

|

X10 |

0.1073 |

2.4016 |

0.03 |

0.3728 |

|

X11 |

2.2077 |

0.2182 |

2.23 |

0.1124 |

|

X20 |

1.1355 |

0.2255 |

1.1418 |

2.1708 |

|

X21 |

3.8157 |

0.0751 |

3.8261 |

2.9894 |

|

X22 |

1.3808 |

0.4142 |

1.3420 |

8.0463 |

|

X30 |

-0.3544 |

0.2041 |

-0.3674 |

0.3177 |

|

X31 |

0.0686 |

0.0002 |

0.0689 |

0.0094 |

As a comparison, the coefficients and standard errors from the individual

least square models are included. It should be noted that the standard errors

for models #2 and #3 under the Gibbs sampler are quite less than under least

squares.

After 50,000 iterations, this is a result for ∑:

|

2.187177 |

-0.62216 |

0.501253 |

|

-0.62216 |

0.188484 |

-0.13562 |

|

0.501253 |

-0.13562 |

0.183619 |

The aforementioned standard

errors are calculated by computing

![]()

In this equation, n represents the number of rows in each model, which, in

this case, is 5.

Reference:

Rossi, P.E.,

Allenby, G.M., and McCullogh, R. Bayesian

Statistics and Marketing. Chichester: John Wiley & Sons, 2005.

Zellner,

A. An Introduction to Bayesian Inference

in Econometrics. New York: John Wiley & Sons, 1970.